paying indiana state taxes late

Set up a separate bank account and regularly deposit collected retail sales tax or other taxes you may owe. Originally turbo tax calculated that I owed Ohio approximately 8000 because of my gambling winnings in Indiana.

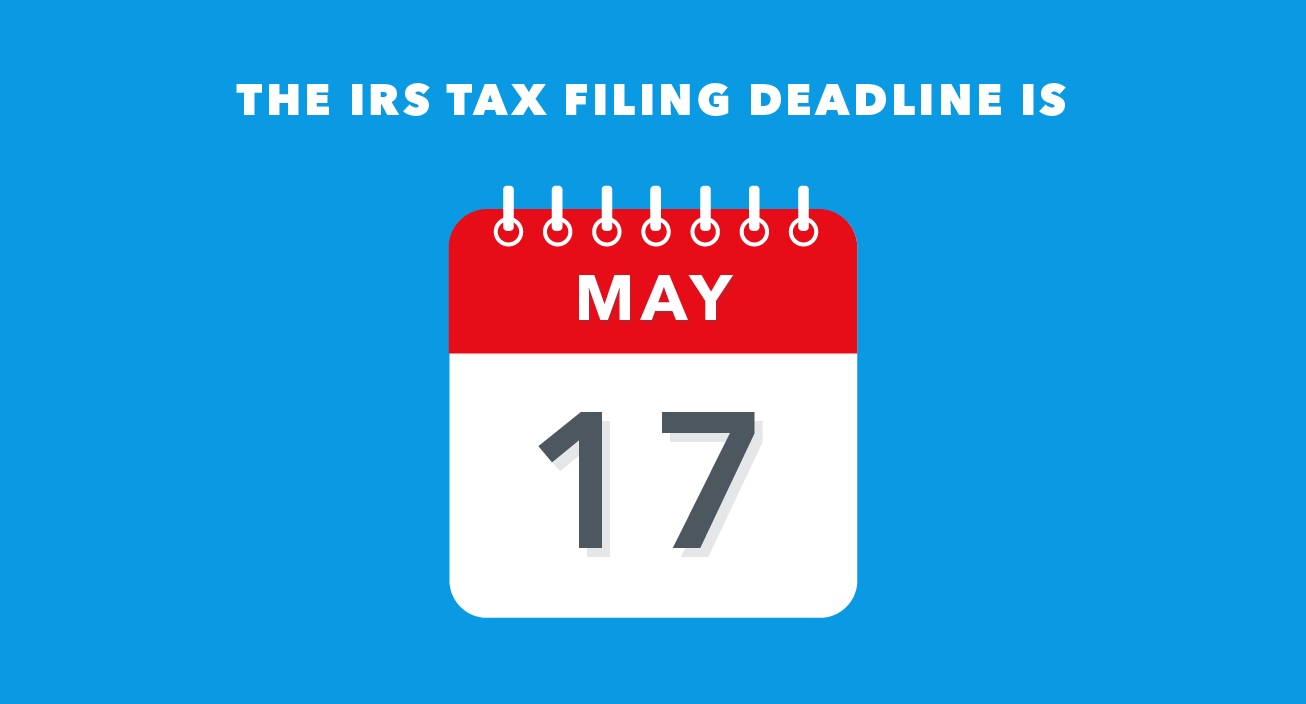

Tax Deadline Extension What Is And Isn T Extended Smartasset

Tax extensions happen automatically and you get the same 6-months you would get from your federal return to file your state taxes.

. Fees applied for paying taxes with a credit card vary depending on the specific tax and payment processor that you use. State Unemployment Tax Act SUTA Indiana Code Title 22 Article 4 Employers are required to either pay SUTA contributions or reimburse the state for benefit payments. The threshold requirements apply to either the current or previous yearDepending on the volume of sales tax liability the filing frequency is either monthly or annually.

To improve lives through tax policies that lead to greater economic growth and opportunity. State B should see Complete Auto Transit Inc. You have 45 days to complete the vehicle title.

Some of the. After this deadline you will have to pay a late registration fee. Please include the following statement from State Rep.

April 17 2023. 203 for refund offsets. What is particularly satisfying about paying property taxes is seeing the tangible results within your community.

If State A imposes a 3-percent sales tax which you paid you are not off the hook if State B has a 5-percent use tax. 274 1977 credit you for the 3-percent tax you paid to State A and require you to pay the 2-percent difference between the tax rates. At the time I was unable to pay for a second state and open a Indiana return.

For example TurboTax has a convenience fee of 249 for credit card payments. After updating my software yesterday and going to amend my taxes now TurboTax says they dont think I need to file a Indiana return and. If your employer refuses to do so consider filing a claim with your states labor agency.

Im having an issue with my 2016 taxes. For larger cases involving a late paycheck or payday laws in general consider hiring a labor attorney to help you. And unless you have an acceptable plan to catch up on your debt under Chapter 13 bankruptcy usually does not allow you to keep property when your creditor has an unpaid mortgage or security lien on it.

Indiana was a FUTA credit reduction state for 940 filing from tax year 2010 through tax year 2015 due to this reason. For example say you were 60 days late on a credit card payment in January 2015. Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels.

Karen Engleman R-Georgetown in your coverage of Indiana Auditor of State Tera Klutz announcing the state will end the fiscal year with 11 billion more than expected. Can I make payments. Get Legal Help to Protect Your Right to a Timely Paycheck.

The first thing you should do is check how many years have passed since your last filing. Im unable to pay my tax liability. It is not too late.

Indiana has a relatively straightforward tax system. Indiana doesnt have local taxes so remote sellers are only liable for the states 7 tax rate. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Paying your fair share really does have visible consequences. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Your household income location filing status and number of personal exemptions.

If the taxpayer pays all delinquencies. The car sales tax is based on the state where you will register your vehicle so you will have to pay only the sales tax of the state where you live. Credit is having an insolvent trust fund.

Personal bankruptcy usually does not erase child support alimony fines taxes and some student loan obligations. A lien is a legal claim against your property to secure payment of your tax debt while a levy actually takes the property to satisfy the tax debt. This late payment should have fallen off your credit report in January 2022.

In some cases a child support order may provide. If I live in another state and buy a car in Indiana where should I pay sales tax. To become a Florida resident for taxes you will need to be living in Florida for more than six months.

If your HOA never filed tax return or has missed paying homeowner association taxes for the past few years dont worry. That said any time you must include a new state in your taxation. A levy is a legal seizure of your property to satisfy a tax debt.

File a suit in small claims court or superior court for the amount owed. Thanks to their adoption of many of the Streamlined Sales Tax State agreement components and because of their flat 700 sales tax rate and no local taxes even out of state sellers dont have to jump through too many hoops. What Sets the Deadline for Child Support Payments.

If you are paying on a parcel that is being garnished through payroll please ensure that you are well within the specified payment window set forth by your employer to avoid double payment. 65 increase in Indianas total MedicaidCHIP enrollment in since late 2013 a year before the state accepted Medicaid expansion Medicare in Indiana As of July 2020 Medigap insurers in Indiana must offer at least Plan A guaranteed-issue to disabled Medicare beneficiaries under age 65. In addition any future federal tax refunds or state income tax refunds that youre due may be seized and applied to your federal tax liability.

As noted above a court may order child support payments to be paid by a non-custodial parentThe payment is considered late when the payment date for example the 1st 15th or end of a month stated in the order is passed and the individual does not make a payment. Then get in touch with the IRS to see whether you can file a Form 1120-H for the. Promptly notify the Department of Revenue if your address andor phone number changes.

You may call the IRS at 800-829-1040 see telephone assistance for hours of operation to discuss any IRS bill. The taxing state has the monetary incentive to retain ones residency and deny Florida residence. The taxing state authority sets its rules for the qualification of Florida residency to avoid state taxation.

What About State Taxes. For over 80 years our goal has remained the same. Without property taxes no public pool no public library no public school for the kids to attend.

A federal tax lien comes into being when the IRS assesses a tax against you and sends you a bill that you neglect or refuse to pay it. Note to the press. While all taxes are part of a grand bargain with the government.

Lets also say that you caught up on your payments and made all payments on time until August 2019 when you became 90 days past due and then caught up again. Levies are different from liens. So the deadline for every state once your extension is filed will be October 16 2023 to file your 2022 state.

Indiana may place a hold on a taxpayers state refund. State Refund Garnishments TRECS. Withdraw the funds only when you pay the taxes.

Contact your local field office.

Tax Deadline 2022 What Happens If You Miss The Tax Deadline Marca

How We Got Here From There A Chronology Of Indiana Property Tax Laws

Indiana State Tax Information Support

E File Indiana Taxes Get A Fast Refund E File Com

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Indiana Sales Tax Small Business Guide Truic

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Tax Penalties Here S What To Do If You Can T Pay Your Taxes This Year Abc7 Chicago

Dor What Happens If I Don T Pay My Indiana Income Taxes

States Vary Widely In Number Of Tax Filers With No Income Tax Liability Tax Foundation

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Prepare Efile Your Indiana State Tax Return For 2021 In 2022

Indiana Sales Tax Information Sales Tax Rates And Deadlines

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

5 Mailing Or Delivery Service Tips For Paper Tax Return Filers Don T Mess With Taxes